Overview

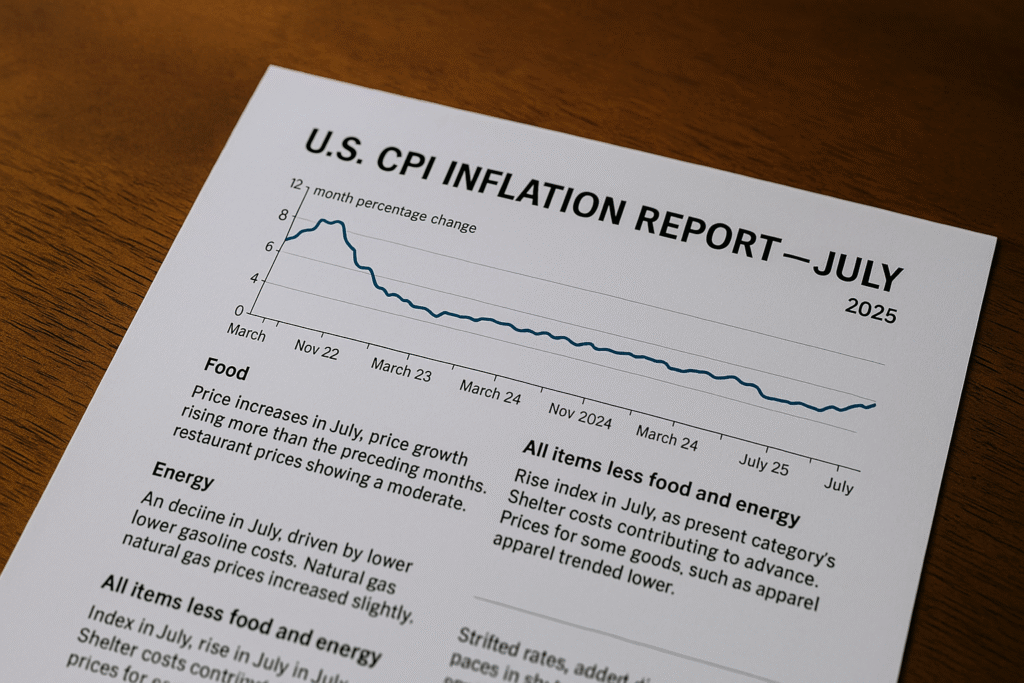

In July 2025, US inflation remained 2.7% year-on-year stable. While this title stability provides some relief, there is a continuous increase in core inflation – the underlying inscriptions built on the exclusion of food and energy – the underlying inscriptions. The markets welcomed the data despite the high obstacles of the Federal Reserve rate cut in September. However, concerns over data integrity and tariff-powered cost pressures.

Headline Figures & Monthly Trends

In July, the Consumer Price Index (CPI-U), which tracks the price change in urban consumers, increased 0.2% month-on-month. This is a slowdown from June’s 0.3% increase.

Announced, the consumer values were 2.7% above, corresponding to the reading of June and slightly below the estimated increase.

Monthly inflation included shelter costs as major contributors, while energy prices fell significantly, and food remained mostly stable.

Core Inflation: The Hidden Heat

Except for food and energy (core CPI), the CPI rose 0.3% every month, which led to the biggest benefit in six months. In the last year, the core CPI sits at 3.1%, which is above 2.9% in June. This upliftment shows increasing costs in services such as medical care, airline rent, and entertainment, suggesting the underlying inflation trends.

Breaking Down the Components

- Food Prices: Overall food costs remained flat – the prices of groceries decreased by about 0.1%, while the dining out increased by about 0.3%. In the last year, the food-at-home inflation sits near 2.2%, while the food-d house (restaurant, fast food) climbed about 3.9%, which reflects constant pressure in food service pricing.

- Energy Prices: The cost of energy fell rapidly, with gasoline reduced by about 2.2% in a month. Electricity and natural gas also decrease. In a 12-month stretch, energy prices fell by 1.6%, which was largely driven by a nearly 10% decline in gasoline, although electricity and gas have still increased considerably from year to year.

- Shelter and Services: Shelter, a major inflation driver, increased 0.2% in July. Medical services, airline fare, and entertainment have seen a visual increase – medical care services increased to close to 0.8%, and the airline fare increased by about 4% for the month. These benefits strengthen the main inflation trends.

- Other goods and services: The car and truck prices rose by about 0.5%, the increase in household goods was minor, and communication services saw a decline. Overall, services remain the most inflationary category, while the goods pressure is slightly decreasing.

What Does It Mean For The Federal Reserve?

The stability of headline inflation strengthens the case for a rate cut in September, showing more than 90% of the possibility in market expectations. However, the growing core inflation policy complicates the outlook, stating that the Fed will move carefully, balancing the price pressure against a soft labor market.

Economists focus on improving the background of inflation, but take care that the pressure related pressure on goods can still contribute to basic inflation over time. Service sector inflation, especially in healthcare and travel, may require close monitoring before decisive action.

Market Reaction And Economic Sentiment

Financial markets replied positively: Stock indices climbed, treasury yields upwards, and investor spirit increased because the possibilities for a lack of monetary policy increased. The “Goldenlox” landscape (not too hot, not too cold) can be optimistic – but underlying risks, wage growth, data credibility, and global business remain in stress.

Data Quality Concerns and Policy Implications

Analyst inflation figures are an alarm. Staffing cuts in the Bureau of Labor Statistics (BLS) have increased dependence on special pricing, particularly in low-solid categories. This creates doubts about whether the reported inflation reflects on-the-ground consumer pricing.

In addition, tariffs imposed earlier this year are appearing in CPI figures – furniture, toy, and equipment prices show initial signs of high costs. Whether it is one-band adjustment or tipping points.

Consumer Impact: Where You Will Notice It

- Gas prices provide relief at the pump below.

- Grocery prices help in stabilising the flat domestic budget.

- The cost of dining out and service increases, an increase in discretionary expenditure.

- The cost of the shelter still increases, increasing the pressure on the tenants and the owners of the house.

- Medical and entertainment expenses continue to trend upwards.

While headline inflation may feel manageable in most daily expenses, important categories such as housing, services, and food are expensive and affect the budget more intensely.

Historical Reference And What Lies Ahead

From the disintegration of the pandemic high and global supply to tariff effects, inflation has increased significantly with an increase from 2021 to 2023. Now in mid-2025, with the CPI being stable at 2.7%, the focus shifts to how long the service-operated pressure lasts, how wages develop, and whether policy changes receive a soft landing or inadvertently increase new risks.

Given further, the Fed’s next inflation figures, wage hike numbers and employment trends. There seems to be a possibility of a vigilant spontaneous path, but uncertainty remains on both supplies and data clarity.

Final Thoughts

The July U.S. CPI report offers a silent headline but a loud warning signal: Core inflation has been made elevated, services are heating up, and data integrity is questioned. There can be space for ease in the Federal Reserve, but only if the future data align with expectations. For consumers, relief is partial – some day-to-day cost is decreasing, but essential services, housing and food remain.

Monitoring these dynamics – especially monitoring core inflation, data quality and macroeconomic signals – will determine whether July is a significant turn or just a temporary stagnation in the story of US inflation.